For many people, tax season can be intimidating, particularly when it comes to completing particular forms and paperwork. The qualified dividends and capital gain tax worksheet is one such important document. For taxpayers who wish to calculate their tax obligations on qualifying dividends and capital gains, this worksheet is essential. This blog post will go into great detail on the contents of this worksheet, how to utilize it efficiently, and why it’s important.

What Are Qualified Dividends?

One kind of dividend that is not subject to the higher ordinary income tax rate is a qualified dividend, which is taxed at the capital gains tax rate. Dividends paid by an American corporation or a qualified foreign corporation must be qualified, and the investor must fulfill holding period requirements to be accepted. The Qualified Dividends and Capital Gains Tax Worksheet is important because it makes it easier for taxpayers to figure out the lower tax rates that apply to these dividends.

What Are Capital Gains?

The profit made from the selling of an asset, such as stocks, bonds, or real estate, is referred to as a capital gain. These gains fall into two categories: short-term and long-term, each with unique tax ramifications. Lower tax rates are available for assets held for more than a year, which are known as long-term capital gains. To prevent taxpayers from overpaying, the Qualified Dividends and Capital Profits Tax Worksheet assists in figuring out the proper tax rate for these profits.

Importance of the Qualified Dividends and Capital Gain Tax Worksheet

To precisely determine the amount of tax due on qualified dividends and capital gains, use the Qualified Dividends and Capital Gains Tax Worksheet. Lower tax rates are advantageous to taxpayers and can save a substantial amount of money. People can avoid making mistakes on this worksheet that could result in overpayment or fines from the IRS by accurately completing it.

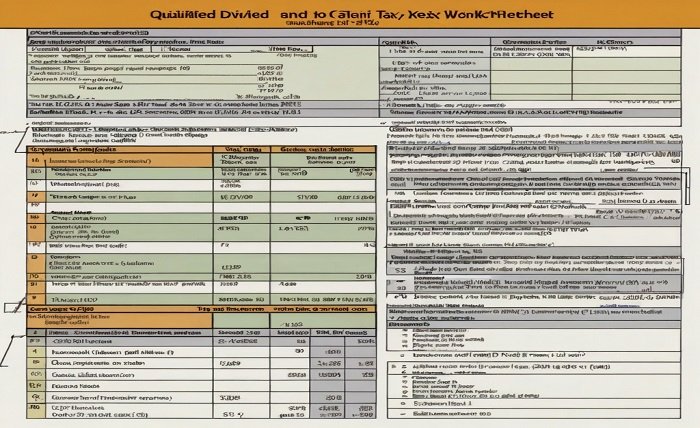

How to Use the Qualified Dividends and Capital Gain Tax Worksheet

Paying close attention to details is necessary while using the Qualified Dividends and Capital Gain Tax Worksheet. Here’s a detailed how-to:

Compile the Information You Need: Gather any pertinent documentation, such as asset sales records and 1099-DIV forms for dividends.

Calculate the Qualified Dividends. Determine which dividends, by IRS guidelines, qualify.

Determine Capital Gains: Keep long-term and short-term capital gains apart.

Complete the Worksheet: To enter the correct amounts for dividends and capital gains, according to the guidelines on the IRS form.

Determine the Tax: To find the amount of tax due, use the worksheet.

Common Mistakes to Avoid

The Qualified Dividends and Capital Gain Tax Worksheet is a standard form that taxpayers frequently fill out incorrectly. These include failing to discriminate between short-term and long-term gains, calculating holding periods erroneously, and misidentifying qualifying dividends. Preventing these mistakes is essential to guaranteeing precise tax computations and evading any sanctions.

Benefits of Using the Qualified Dividends and Capital Gain Tax Worksheet

There are various advantages to using the Qualified Dividends and Capital Gain Tax Worksheet. It guarantees that the reduced tax rates on qualifying dividends and long-term capital gains are fully utilized by taxpayers. People may be able to keep more of their investment profits as a result of the potential for significant tax savings. Furthermore, correct use of the worksheet lowers the possibility of audits and penalties while preserving compliance with IRS requirements.

Resources and Tools

The Qualified Dividends and Capital Gain Tax Worksheet can be used by taxpayers with the help of several tools and resources. While tax preparation software can automate much of the procedure, the IRS website offers comprehensive instructions and examples. A tax professional’s advice can also guarantee precise worksheet completion and offer tailored counsel.

Conclusion

For taxpayers who have investments, the Qualified Dividends and Capital Gains Tax Worksheet is an essential resource. People can drastically lower their tax obligations by knowing what eligible dividends and capital gains are, appreciating the worksheet’s significance, and utilizing it appropriately. The advantages of this crucial tax document can be further increased by avoiding frequent blunders and making use of the available tools.

FAQ

What does the Qualified Dividends and Capital Gains Tax Worksheet aim to accomplish? To ensure they receive reduced tax rates, the worksheet assists taxpayers in determining the accurate tax due on qualifying dividends and capital gains.

The Qualified Dividends and Capital Gains Tax Worksheet is intended for use by who? This worksheet is intended to help taxpayers who have long-term capital gains or qualifying dividends accurately calculate their tax liabilities.

What conditions must be met for dividends to be qualified? A U.S. corporation or a qualifying foreign firm must pay dividends, and the investor must adhere to holding period rules.

How can I use the Qualified Dividends and Capital Gain Tax Worksheet without making mistakes? Pay close attention to IRS regulations, verify computations, and think about employing tax preparation software or seeking advice from a tax expert.

Where is the worksheet for qualified dividends and capital gains tax available? The worksheet, together with thorough instructions and examples to help taxpayers complete it, may be found on the IRS website.